Facturation électronique – Les entreprises passeront-elles à la facturation entièrement électronique?

AVERTISSEMENT : Les articles reflètent les intérêts et les opinions de leur auteur et ne sauraient constituer des déclarations ou des prises de position officielles de Paiements Canada.

Résumé1

La majorité des entreprises au Canada utilisent exclusivement la facturation électronique, ou une combinaison de facturation papier et électronique.2 Avec l’introduction de la norme ISO 20022, nous nous attendons à ce qu’un plus grand nombre d’entreprises, en particulier celles du secteur commercial, passent entièrement à la facturation électronique. Les entreprises du secteur du commerce de détail (principalement des PME) continueront probablement d’utiliser la facturation papier ou une combinaison de facturation papier et électronique. Cette situation leur convient et les améliorations marginales associées à la facturation électronique ne justifient pas selon elles le passage à la facturation entièrement électronique.3

Dans cet article, nous présentons un aperçu de l’adoption de la facturation électronique par des entreprises au Canada, les raisons pour lesquelles un plus grand nombre d’entreprises ne passent pas complètement à la facturation électronique, nous analysons la question à savoir si ce passage est justifié pour toutes les entreprises ainsi que l’incidence de la norme ISO 20022 sur l’adoption de la facturation électronique.

La suite de cet article est en anglais seulement.

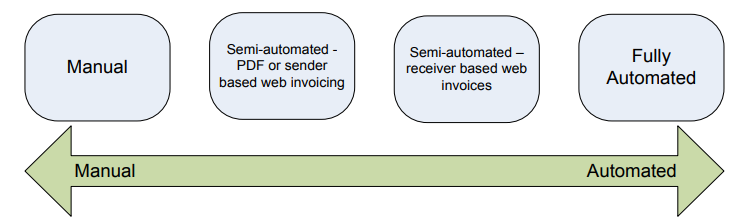

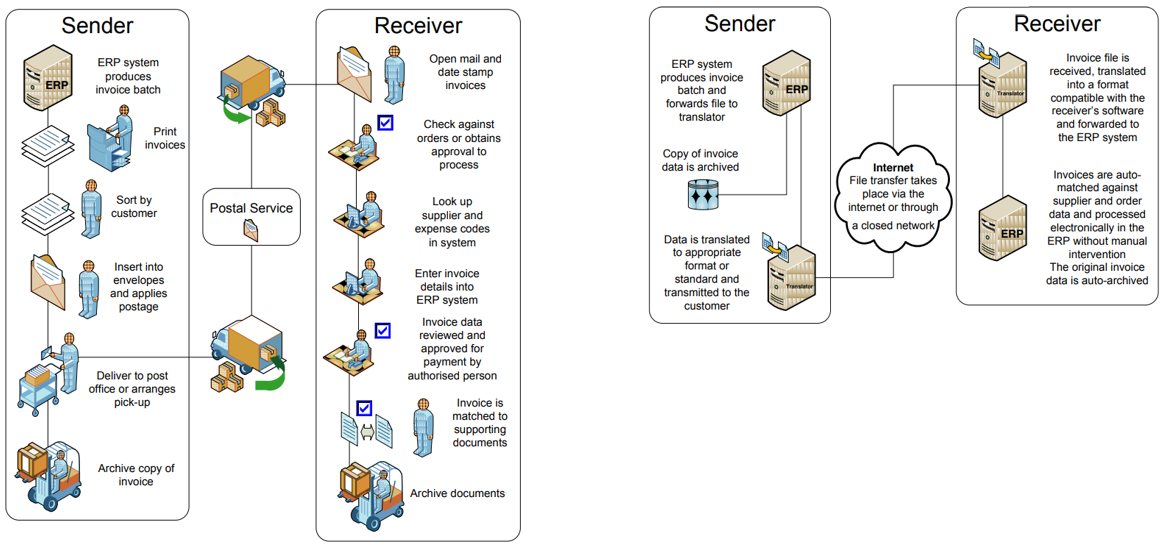

Electronic invoicing (or e-invoicing) is the electronic transfer and storage of invoicing information (billing and payment) between a buyer and supplier. It can take a variety of forms, as illustrated in Figure 1. On one end of the spectrum, it can be a highly manual process requiring human intervention for the printing, sorting, envelope-stuffing, and mailing of an invoice batch. On the other end of the spectrum, it can be a fully electronic and automated end-to-end process.4

Figure 1: E-invoicing Options Based on the Level of Automation5

Manual Approach Fully Automated Approach

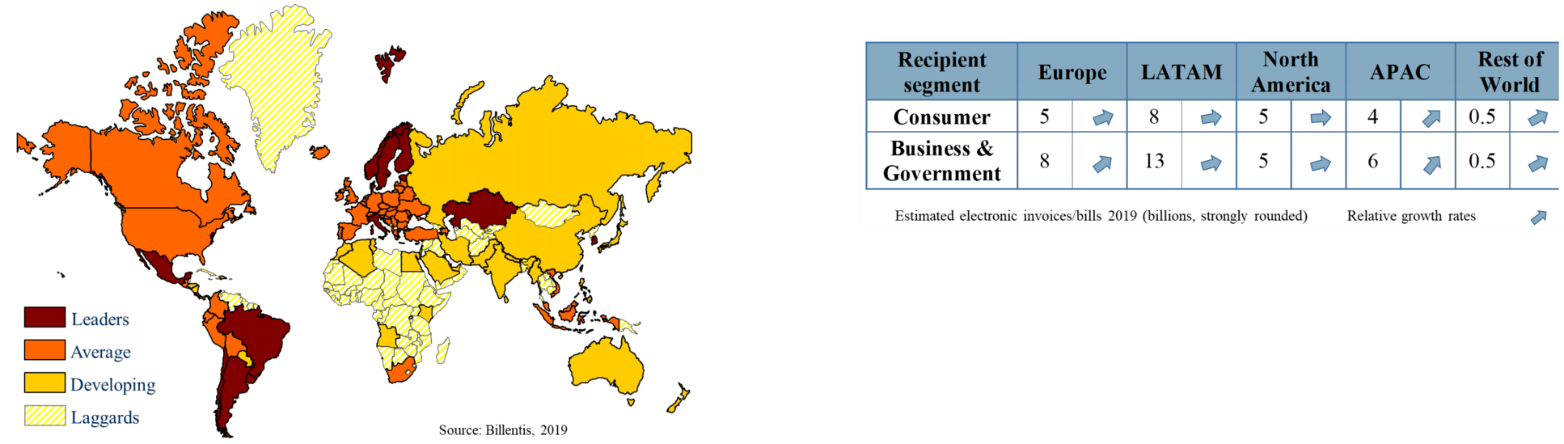

In Canada, close to half of all businesses (45 per cent) exclusively use e-invoicing for sending customer invoices, while 37 per cent exclusively use e-invoicing for receiving supplier invoices. On the other hand, about one in five businesses (17 per cent) exclusively use paper invoicing for sending customer invoices, while 11 per cent exclusively use paper invoicing for receiving supplier invoices.6 When looking at e-invoicing adoption among total businesses (including B2C, B2B, and B2G) from a global context, Canada is about average, and is comparable to the U.S. and European nations, but lags Italy, Kazakhstan, and Latin American and Nordic countries (see Figure 2). Estimated growth rates for the volume of e-invoices for 2019 are higher for Asia Pacific, Europe, and Latin America versus North America (see Figure 3).7

Figure 2: Market Maturity for E-invoices8 Figure 3: Estimated Volume of E-invoices in 20199

Why aren't more Canadian businesses completely switching to e-invoicing?

The benefits of e-invoicing have long been known and established among businesses that use it. According to the results of a 2011 survey conducted by Paystream Advisors on what benefits businesses observed via the adoption of e-invoicing solutions, the primary benefits include: fewer lost or missing invoices; better visibility across the transaction life cycle; fewer exceptions and discrepancies; quicker approval cycles; increased on-time payments; increased ability to capture discounts; fewer duplicate invoices; and increased vendor satisfaction.10 Furthermore, according to findings from the 2020 Leger/Payments Canada Business Payments Behaviour survey, when asked which type of invoices the business prefers sending its customers, two out of three Canadian businesses (67 per cent) indicated that they prefer e-invoices. An even greater proportion of businesses (73 per cent) indicated they prefer e-invoices when receiving supplier invoices.11 This begs the question: why aren’t more Canadian businesses completely switching to e-invoicing?

There are a number of reasons preventing more Canadian businesses from fully switching to e-invoicing. The primary reasons why businesses send paper invoices to their customers are: customer preference; a reluctance to change their approach as it has always been set up this way; and convenience (i.e., easier for the business). The primary reasons why businesses receive paper invoices from their suppliers are convenience and traceability.12 In Canada, 98 per cent of all businesses are small businesses,13 which make up the majority of B2Cs.14 Small SMEs15 alone account for 50 per cent of all B2C businesses.16 Despite the fact that less than two in five B2C businesses send e-invoices to customers, more than half (52 per cent) receive and reconcile customer payments within two weeks. So, the benefits of e-invoicing to small business owners are less apparent than to larger-sized businesses likely because they have fewer customer payments.17 Many businesses that receive paper invoices from suppliers prefer this format over e-invoicing, because it is easier for them to keep track of payments and is more convenient. They can attach a cheque payment along with the paper invoice so that all of the information is together, which makes it easier to trace and reconcile payments. It also allows businesses to have an accurate paper trail at their fingertips.18 Other reasons why businesses prefer paper invoicing include: it is the fastest way for businesses to process payments; it is perceived to be more secure; it is good enough for the number of invoices the business sends/receives; it is the least expensive option; and supplier preference.19 According to a 2018 study by the advocacy group Consumer Action, overall, 38 per cent of consumers preferred receiving bills and other important notices in the mail, 26 per cent preferred digital (email or online), while 36 per cent said it depended on the type of communication. Moreover, consumers indicated a particularly strong preference for paper for non-monthly bills such as medical bills, property taxes, and motor vehicle renewals.20 Consumers who prefer receiving paper invoices feel this way for several reasons: they want a paper bill as a reminder to pay; they worry about not reviewing or noticing errors if the bill is in electronic format; they worry about electronic notices getting blocked by spam filters or lost in their in-boxes; and they prefer having a physical paper trail for safer and easier record-keeping.21

Does e-invoicing make sense for all businesses?

For businesses that only use paper invoicing, they do not know what they do not know. Because they have never used e-invoicing before, they have no reference point beyond what they are currently using. To them, paper invoicing works well enough. So, increasing business awareness and education on the benefits of switching from paper to electronic invoicing is key. E-invoicing saves businesses time and money, and increases productivity by digitizing and automating all of the back-office work. Does e-invoicing make sense for all businesses – that is, are the benefits of e-invoicing the same across all businesses regardless of their size?

Large SMEs22 and commercial businesses23 likely stand to benefit more from completely switching to e-invoicing than small SMEs because they handle a larger volume of invoices and deal with larger amounts from suppliers than small SMEs. They are also better positioned to leverage the benefits of moving towards a fully automated e-invoicing approach for several reasons. First, they are more likely to already use a combination of paper and electronic invoicing for sending customer invoices and receiving supplier invoices than small SMEs.24 Second, they are more likely to use an accounting software package/ERP25 than small SMEs.26 Third, they are more likely to be aware of and interested in implementing Straight-Through Processing (STP), which might be considered the pinnacle of a fully electronic and automated end-to-end solution for processing payments. Large SMEs and commercial businesses would benefit the most from implementing STP automation, since they are more likely to handle larger amounts of money, and deal with larger transaction volumes than small SMEs. So, many of the savings presented by STP are worth the upfront investment cost.27

However, there are a number of reasons why small SMEs could also greatly benefit by completely moving from paper to electronic invoicing. First, although small SMEs do not handle nearly the same volume of customer invoices as larger-sized businesses do, e-invoicing would reduce the time between sending an invoice to a customer and receiving payment. Second, small business owners can ensure that the intended recipients receive their invoices, and they could receive a notification when the customer opens and reads an invoice. Third, e-invoicing software allows the user to automatically send invoices at specific dates and times, so they can be sent to customers at the right time. Fourth, e-invoicing software allows the user to set automatic reminders for each customer, and notify them of payment due dates, which helps better ensure on-time payment. In turn, this helps improve overall cash flow efficiency for the small business owner. Fifth, e-invoicing helps eliminate errors by removing many of the manual processing steps found in paper invoicing, thereby reducing overall cost. Sixth, it also allows small business owners to have a global view of their finances by providing analytics data that can be used to monitor the status of customer accounts, invoices that have yet to be paid, or customers who are late in their payment. At the same time, if there is an error on a customer invoice, it can be found and fixed more quickly than with paper invoicing, which helps improve customer relationships.28

Will ISO 20022 hasten e-invoicing adoption among businesses?

A key frustration of Canadian businesses that accept electronic payment methods for client payments is that invoice and other payment details must travel to the beneficiary separately from the payment itself. As a result, businesses have to manually reconcile each payment, which is both costly and timely. For businesses that are considering implementing STP, this issue might prevent them from proceeding. A 2018 study published by EY/Payments Canada cites:

“The absence of detailed remittance data traveling alongside an electronic payment results in low rates of straight-through processing as there is usually insufficient information upon arrival for a payment to be automatically matched to their corresponding invoices. Despite automation efforts to increase the efficiency of payments application processes, on average, approximately 75% of payments are automatically matched to invoices. The level of inefficiencies arising from matching and reconciling today’s batch payments to invoices, purchase orders and contractual agreements grows in correlation with the volume of transactions and supply chain complexity.”29

So, better invoice data could solve the issue of low auto-match rates of payments to invoices. It would enable solutions for automated payments processing, and better payment tracking.30 ISO 20022,31 which offers data-rich payments, will make e-invoicing a more attractive and feasible option for some businesses. It will help to address a key concern of e-invoicing – ease of payments reconciliation, because it helps facilitate easier and accurate e-invoice/payment matching.

Although ISO 20022’s benefits on e-invoicing are clear, ISO 20022’s overall appeal is stronger among larger-sized businesses, particularly commercial businesses, likely because they deal with larger payment volumes, and many have an accounting software/ERP or STP set up, or plan to invest in one. Commercial businesses perceive among ISO 20022’s most important benefits the enabling of greater e-invoicing and payment processing automation, the ability to integrate payment messages with accounting software/ERP, and less manual intervention with payment processing and invoice reconciliation.32 Small SMEs are least familiar with ISO 20022 (seven per cent), compared to commercial businesses (29 per cent). So education is key to improving interest in ISO 20022 and its benefits on e-invoicing among small SMEs.33

This paper has explained the benefits of completely moving from paper to electronic invoicing for businesses. Not all of these benefits carry the same importance to businesses – in particular, small SMEs, but small SMEs are unaware of all of these benefits. Many small SMEs and larger-sized businesses share the same primary payment challenges: delays in incoming and outgoing payments, and cash flow management issues.34 So, there is a need for a better, more efficient invoicing solution for businesses, both large and small. This past pandemic year has shown Canadian businesses to be resilient, adapting their business model (i.e., moving to/focusing more on their e-commerce platform and embracing digital payments) to stay afloat. It has also made businesses focus on becoming more efficient and cost-conscious. As the Canadian economy continues to feel the impact of the pandemic, there will be continued pressure on businesses to be resilient, efficient, and innovative. E-invoicing represents another tool in a business’ toolkit to satisfy these aims.

1 The views presented in this paper are those of the authors and do not necessarily reflect the views of Payments Canada.

2 Leger/Payments Canada. 2020 Business Payments Behaviour Tracker Survey (July 2020).

3 Ibid.

4 Deloitte, “Department of Finance and Deregulation – An Overview of E-invoicing”, Deloitte, Jan. 9, 2012.

5 Ibid.

6 Leger/Payments Canada. 2020 Business Payments Behaviour Tracker Survey (July 2020).

7 Bruno Koch & Billentis, “The E-invoicing Journey 2019-2025”, Billentis, Fourth Edition, September 2019.

8 Ibid.

9 Ibid.

10 Ibid.

11 Leger/Payments Canada. 2020 Business Payments Behaviour Tracker Survey (July 2020).

12 Ibid.

13 Definition of ‘small business’ - businesses whose annual revenue are less than $10 million.

14 Definition of ‘B2C’ - businesses that operate a business-to-consumer model (i.e., sell to consumers).

15 Definition of ‘Small SME’ - businesses whose annual revenue are less than $500 thousand.

16 Ibid.

17 Ibid.

18 Leger/Payments Canada. 2020 Business Payments Behaviour Tracker Survey (July 2020).

19 Ibid.

20 P. Sabatini, “Consumers still prefer paper bills, but can they make you go digital?” Pittsburgh Post Gazette, Feb. 19, 2019. https://www.post-gazette.com/business/money/2019/02/20/Consumers-paper-bills-email-statements-spam/stories/201902190113.

21 Ibid.

22 Definition of ‘Large SME’ - businesses whose annual revenue are between $500 thousand and less than $10 million.

23 Definition of ‘commercial business’ - businesses whose annual revenue are between $10 million and less than $500 million. (Note: Leger/Payments Canada 2020 Business Payments Behaviour Tracker Survey only looks at commercial businesses with annual revenues up to $500 million).

24 Leger/Payments Canada. 2020 Business Payments Behaviour Tracker Survey (July 2020).

25 Definition of ‘ERP’ - Enterprise Resource Planning is a process used by companies to manage and integrate the important parts of their businesses. An ERP software system can integrate planning, purchasing inventory, sales, marketing, finance, human resources, and more.

26 Leger/Payments Canada. 2020 Business Payments Behaviour Tracker Survey (March 2020).

27 Leger/Payments Canada. 2020 Business Payments Behaviour Tracker Survey (July 2020).

28 QuickBooks Canada Team, “The Top Benefits of Electronic Invoicing”. https://quickbooks.intuit.com/ca/resources/invoicing/small-business-invoicing-trends/#:~:text=Your%20cash%20flow%20fluctuates%20%E2%80%93%20sometimes,invoices%20are%20accessible%20from%20anywhere

29 EY/Payments Canada. “How can payments modernization benefit Canadian businesses? Evaluating the cost of payments processing” (2018).

30 Ibid.

31 Definition of ‘ISO 20022’ - Is an international standard that will help with payments messaging. When a business receives an electronic payment from its supplier, the business will be able to access more information about the payment than in the past. These additional payment details could include invoice number, name of the supplier, purchase order number, etc. A key benefit of this standard would be the possibility to integrate the payment messages received within the business’ Enterprise Resource Planning (ERP) and/or accounting software. It will help the business with payments tracking and reconciliation, fraud prevention, and improved analytics.

32 Leger/Payments Canada. 2020 Business Payments Behaviour Tracker Survey (December 2020).

33 Ibid.

34 Ibid.

Author

Stephen Yun

Stephen Yun is a Senior Analyst, Market Insights at Payments Canada, whose areas of focus include the Consumer Payment Methods and Trends and Payment Behaviour Tracking studies, and leveraging research insights to create a consumer/business payments narrative and drive business action for his business partners. Stephen has more than 15 years of experience leading marketing and customer experience research. He has held progressively senior roles within marketing research on both the client and supplier side, serving different vertical markets (including financial services, consumer packaged goods, and educational services). He holds MBA and BBA degrees from the Schulich School of Business (York University) specializing in Marketing and Finance.