Portrait sommaire de l’évolution des paiements transfrontaliers

AVERTISSEMENT : Les articles reflètent les intérêts et les opinions de leur auteur et ne sauraient constituer des déclarations ou des prises de position officielles de Paiements Canada.

Résumé

En 2018, pas moins de 23,7 billions de dollars de transactions ont traversé les frontières, essentiellement sous la forme de paiements d’entreprise. C’est donc dire que la demande d’opérateurs de systèmes de paiements et de fournisseur de services de paiement pour faciliter ces mouvements à grande échelle n’a jamais été aussi forte. La croissance soutenue du commerce électronique, qui a fait bondir les paiements de détail interentreprises ou de personne à entreprise, incite tout particulièrement à porter une plus grande attention à ces activités transfrontalières, à l’évolution de l’écosystème des paiements et à la recherche de solutions pour faciliter ce genre de transactions.

C’est dans cette optique que nous proposons un survol des méthodes de paiements transfrontaliers, en présentant notamment une partie des grands canaux d’échange et leurs avantages et désavantages. Nous abordons également certaines avancées du secteur comme SWIFT gpi et les projets en lien avec le transfert de fonds à l’échelle internationale à l’aide de monnaies numériques (le projet Jasper-Ubin, le réseau d’information interbancaire de J.P Morgan et la cryptomonnaie Libra de Facebook).

La suite de cet article est en anglais seulement.

What is a Cross-Border Payment?

A Cross-Border payment is a transaction in which funds are sent from an entity in one country to a recipient in a different country. In most cases, the sender and the receiver of the payment do not share a common ledger and transactions between the two countries involve a series of intermediary transactions. At the global level, cross-border transactions accounted for $23.7 trillion in value in 2018.1 Most of these cross-border transactions are corporate payments. The increase in cross-border payments volume can be attributed to growth in e-Commerce; both B2B and P2B cross-border retail payments.2 Current trends suggest that the demand for cross-border payments will continue to grow, however, cross-border payments remain slow, expensive, and lack transparency relative to many domestic payment systems. As such, there are tangible disruptive opportunities for incumbents and emerging fintechs to exploit and improve the facilitation of cross-border payments more specifically in Canada.

Cross-Border Payments Overview

Cross-border payments are typically settled via correspondent banking, which involves two banks establishing reciprocal accounts with each other. The correspondent accounts are referred to as nostro and vostro accounts.3 For example, a Canadian bank obtains correspondent banking services from an American bank that holds a nostro account on behalf of the Canadian bank, where the funds in the account are denominated in USD. On the other hand, the American bank has a reciprocal account in the Canadian bank, called the vostro account in which the funds are denominated in CAD. Essentially, financial institutions (FI) are holding balances with each other, making correspondent banking relationships highly interdependent.

Correspondent Banking Cross-Border Settlement

Most cross-border transactions are made through a network of correspondent banks, which is the way most jurisdictions make cross-border payments. Correspondent banking cross-border transactions can involve multiple banks during the transaction process. In the most basic terms, the correspondent holds deposits owned by other respondent banks and provides payment services to those banks.4 Essentially, this is a bilateral agreement between the two banks in which they provide services to each other.

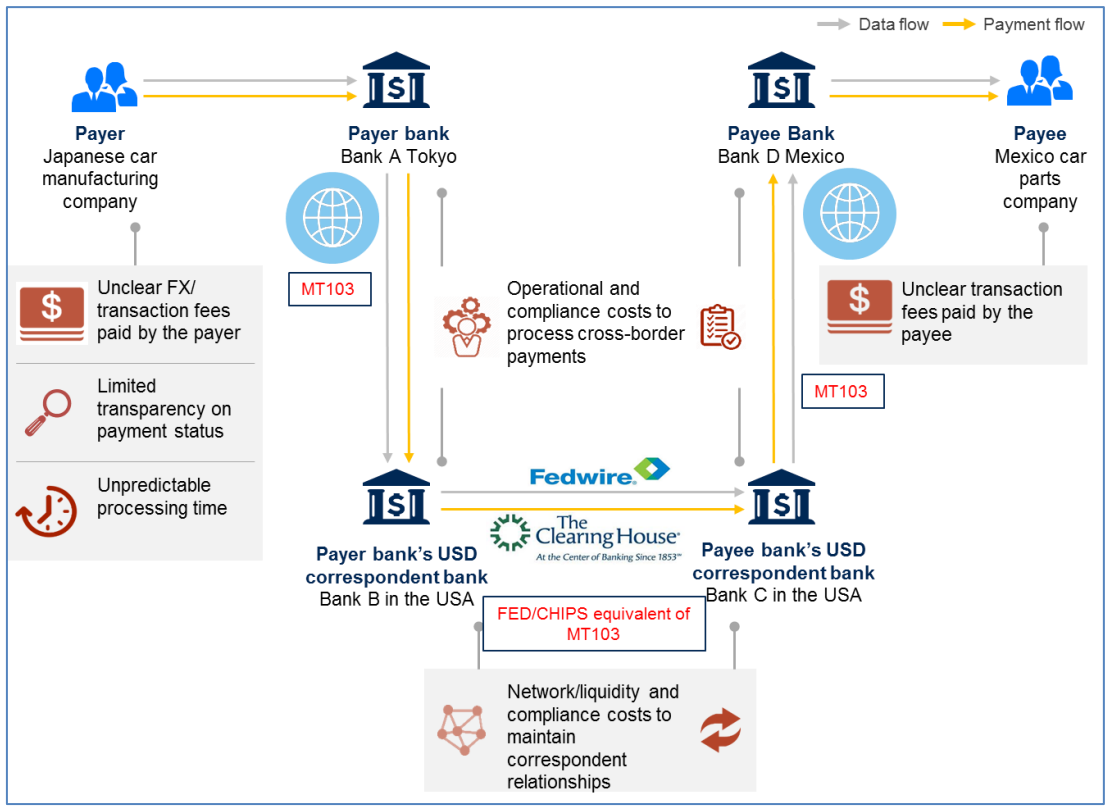

Figure 1: Correspondent Banking Payment Flow Chart.

Source: SWIFT Institute (2018). The Future of Correspondent Banking.5

In the simplest form of cross-border correspondent banking, two banks have a direct bilateral correspondent relationship. For example, Bob in Canada wants to send $100 CAD to Alisa in the US. To do so, Bob will initiate the payment from Bank A in Canada, and Bank A has the nostro account of Bank B, an American bank. Since Bank A has a direct bilateral account relationship with Bank B, the settlement instruction as well as payment information can travel in a single message. The SWIFT standard for such a payment message is MT103.6

However, most of the time, banks do not have direct bilateral correspondent relationships with their designated receiving bank. In these cases, it can involve multiple banks as intermediaries for the funds to transfer.

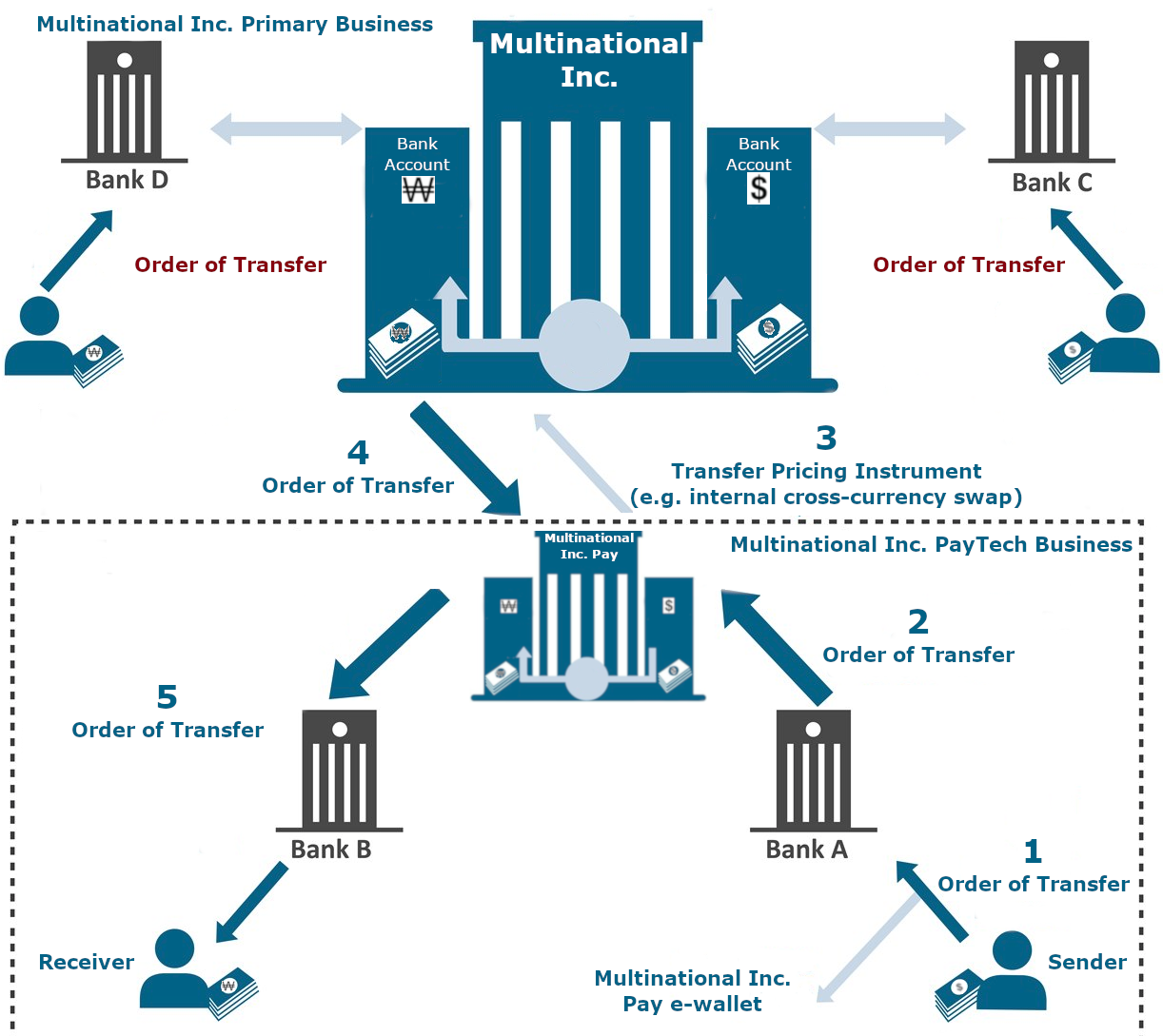

Some of the financial services that provide cross-border funds transfer such as Samsung Pay, Google Pay, Apple Pay, and Transferwise are derivatives of the correspondent banking model. Making a cross-border payment using any of these large global fintechs can be reduced to a form of transfer pricing where the intermediate product is foreign exchange held in bank accounts in different countries. Cross-border payments initiated using services provided by such companies are essentially on-us transactions in their global balance sheets, with funds merely transferring from one e-wallet to another e-wallet. This transfer pricing plays an important role for large companies in managing their tax reporting and other aspects of their asset-liability management across the various jurisdictions in which they operate. Therefore, the birth of the fintech divisions of these companies may not be driven by providing payment services but by tax harmonisation amongst other things.

As illustrated in Figure 2, an organization with a global presence could establish a paytech division that offers payment services across jurisdictions in which that organization operates. It is then able to use these payment services as a mechanism for managing its cross jurisdictional currency balances through internal or inter-divisional transactions. In the example in Figure 2, the paytech division of the multinational enters into South Korean won vs Canadian dollar cross-currency swaps or buys South Korean won from the Korean arm of the parent company to facilitate a payment from a Canadian customer to a Korean merchant. This not only helps avoid expenditure on fees for cross-border cash management by the multinational, it also minimises the potential for lost interest revenues for sitting on large cash balances, and can assist in tax harmonization across various jurisdictions.

Figure 2: PayTech Transfer Pricing Payment Flow Chart.

Risks Associated with Correspondent Banking

While correspondent banking enables cross-border payments across jurisdictions, there are some key drawbacks to the current correspondent banking model. Payments are slow to process, lack transparency, entail high transaction costs, and leave exposure to foreign exchange risk (FX), counterparty and regulatory risks. High-value cross-border transactions through correspondent banking are exposed to settlement risk because financial institutions often lack real-time visibility into the settlement process, which could possibly create a chain reaction that leads to a default. There is additionally the issue a lack of harmonization of ISO20022 implementation as well as operating hours in the various real time gross settlement systems operated by central banks and financial market infrastructure operators around the world.

More importantly, these risks not only impact commercial banks and central banks to various degrees, but also have consequences for the end-user experience in trying to pay recipients in other countries. Indeed, from a consumer standpoint, cross-border payments also present a number of challenges in terms of fees, remittance information visibility into the transaction life cycle; including knowing what stage in the transfer process the payment is in and when the funds transfer is complete. The root causes of the risks related to correspondent banking model show a few recurring themes: lack of consistent payment standards for cross-border payments, reliance on multiple intermediaries, time zone differences and subsequent varying operation hours between jurisdictions.

The current cross-border payment model is entrenched in correspondent banking model, which is sticky and difficult to innovate and build upon. Creating an entirely new cross-border infrastructure can be complex, costly, and accompanied with many uncertainties. The technical barriers to innovation in cross-border payments may limit service offerings by emerging fintechs to the correspondent banking model; the above mentioned risks may carry over to the new cross-border payment technology.

There has, nevertheless, been some progress to improve cross-border payments infrastructures. For example, the SWIFT gpi was launched in 2017, and aims to solve the inefficiencies in existing messaging and processing systems between FI’s by standardizing the messaging format used in cross-border payments. The result is that over 95 per cent of payments through SWIFT can be processed within 24 hours of the transaction taking place.7 Moreover, the SWIFT gpi now includes instant global payments as well as gpi stop and go functionality with a pivot towards expediting cross-border B2B transactions. Currently, there are over 1100 FI’s around the world supporting the flow of payment messages through SWIFT gpi, with over $300 billion USD sent daily over the platform.8 While SWIFT gpi is a significant improvement to the cross-border payments infrastructure, SWIFT does not transfer money across jurisdictions -- only the messages -- and fund transfers still requires settlement via correspondent banking and/or local real-time payment systems as trialed between July and September 2019 through the integration of SWIFT gpi Instant into Singapore’s domestic instant payment service, Fast And Secure Transfers (FAST), Australia’s New Payments Platform (NPP), and Europe’s TARGET Instant Payments Settlement (TIPS) and other jurisdictions.9

Digital Currencies and Cross-Border Settlement10

Digital currencies (such as Bitcoin 11, the first cryptocurrency ever created) are inherently borderless and bound to no jurisdictions or bricks and mortar, seemingly making them ideal for facilitating cross-border payments. Transferring digital currencies will create a new “block” that contains the transaction information, including fees, which are closed by a type of cryptographic signature. These blocks containing transaction information are continuously accumulated on top of existing processed blocks to collectively form the blockchain that forms part of what is referred to as distributed ledger technology (DLT). In short, the distributed ledger is a database of all transactions executed in the currency that is consensually, in near real-time, updated, shared and synchronized across all participants in the currency’s ecosystem. This means that everyone will have a copy of a ledger containing all transaction information. In this model, there is no central authority that acts as an arbitrator or a monitor, and the distributed ledger enables greater transparency and redundancy to guard against operational outages of nodes in network. It should be noted, even with the ledger being shared across the payment network, full visibility into the transactions can be structured in a permissioned fashion to permit oversight and fraud detection while maintaining privacy.

Leveraging DLT to facilitate cross-border payment implies that the network is decentralized and payments are settled via digital currency or cryptocurrency almost instantaneously. To this end Mark Carney, former Governor of the Bank of Canada and current Governor of the Bank of England, has publicly welcomed innovations in the DLT and fintech space such as the Facebook led Libra digital currency. There is a plethora of digital currencies in the market currently, the main categories of which are:

- Central Bank Digital Currency.

- Private label digital currencies which can be broken down into:

- Commercial bank issued, closed-system digital currency.

- Private company issued, closed-system digital currency

- Public full open digital currencies including stable coins.

Central Bank Digital Currency and Cross-border Settlement

Central Bank Digital Currency (CBDC) is a digital form of fiat currency established as money by government regulation or law and issued by the central bank.12 There are two variations of CBDC prototypes: wholesale and general purpose. Implementation of Wholesale CBDC for cross-border settlement may bring several potential advantages: 13

- Faster and more timely processing of transactions (24/7) as opposed to current limited operating hours.

- Transparency and straight through processing.

- Enabling innovations and onledger exchange and settlement.

- A closed system which minimizes cybersecurity risk.

Project Jasper-Ubin14, a joint project between Payments Canada, the Bank of Canada, the Bank of England, the Monetary Authority of Singapore, and a consortium of global commercial banks headed by HSBC and JP Morgan explored the use of CBDC on the blockchain DLT to settle cross-border payments.15 Project Jasper-Ubin is permission-based system and it is still in development.16The main difference relative to the correspondent banking model is that the intermediaries in Project Jasper-Ubin do not hold funds on behalf of other intermediaries, therefore eliminating counterparty credit risk and reducing settlement risk.

Project Jasper-Ubin performs transactions across the Quorum-based DLT network in Singapore and the Corda-based DLT network in Canada using the Hash Time Locked Contract design (HTLC). HTLC employs smart contracts to synchronize all payment actions, meaning transactions either succeed or fail.17 For example, a sender will transfer local currency to an intermediary on the local currency network, and the intermediary will transfer the foreign currency to the receiver on the foreign currency network. The receiver will know when they will receive the payment by generating a cryptographic proof of payment. In cases where it fails to claim the payment, the payment will be returned to the payor. This system using HTLC would not need to place trust in a third party but trust is required in the technical system. Project Jasper-Ubin is still an experimental project, and it went through successful tests of cross-border transactions between Canada and Singapore. The project itself is still in the development stage with more opportunities for research remaining open.

Private Label Cryptocurrency and Cross-Border Payment

In this experimental model, consortiums of commercial banks or entities issue digital tokens on an agreed upon digital currency standard to execute cross-border settlement and other exchanges of value in a closed system. The digital token is typically backed by central bank issued fiat currency in the form of collateralized liquidity or other asset or liability deposits at or guaranteed by the central bank or some other trusted entity. The two examples of these are the Utility Settlement Coin (USC)18, and the JP Morgan Coin (JPM Coin)19. Cross-border settlement using either USC or JPM coin leverages the blockchain to ensure faster and more secure cross-border payments by straight-through processing and improvements to transparency.

USC is an experimental digital cash instrument built on DLT and originated by the Swiss global financial services company UBS in partnership with Clearmatics Technologies in a consortium of fourteen banks. As of 2019, the consortium raised $63 million in funding from the 14 shareholder banks.20 In the USC model, large private banks and fintech firms create digital tokens (USC) representing money from multiple countries that can be exchanged on a distributed ledger platform. The digital token is fully collateralized by the cash balances of participating banks which are held on the books of the central bank. Unlike Bitcoin, USC is created through liability securitization. The decentralized nature of USC enables its members to settle inter-bank positions more efficiently. Moreover, USC may also be issued by transferring non-operating cash balances into a special purpose vehicle (SPV) that manages cash without a profit making objective. This has the benefit of reducing the regulatory collateral requirements of the participating financial institutions by moving non-profitable high liquidity flight risk deposits off their balance sheets while being able to use the liquidity for transaction settlement purposes.

Similar to USC, JPM Coin is also an experimental digital coin built on the DLT , originated by J.P. Morgan Chase. JPM coin is a digital token, redeemable in a 1:1 ratio to the US dollar. The purpose of JPM Coin is transferring value in cross-border settlement. JPM Coin is permissioned, its users are exclusively institutional customers, and it employs the Quorum ledger.

Additionally, J.P. Morgan launched, as a pilot program, the Quorum-based Interbank Information Network (IIN) in 2017. The IIN allows member banks to exchange payment information to overcome the challenge of sharing such information in cross-border settlement. As of April 2019, there are 220 member banks across the world participating in the IIN. These include four of the Canadian designated systemically important banks (DSIBs); Bank of Montreal, Royal Bank of Canada, TD Bank, and National Bank of Canada21. Both the IIN and JPM Coin aim to address the shortcomings of correspondent banking in terms of information sharing and settlement. However, they may also be disruptive to central clearing services offered by organizations such as Payments Canada and sideline the traditional wholesale payments space.

Looking at potential disruption to wholesale payment systems is crucial because a payment is the endpoint of a contract or agreement, the details of which are recorded on the bank’s financial statements. It is these contracts that provide the business case for USC and JPM Coin. A business case for USC would be to provide a vehicle for settlement within derivatives markets.22 An example would be the market for cross-currency and interest rate swaps. To this end, it is important to note that the gross notional value of outstanding contracts in the over-the-counter (OTC) derivatives markets at the end of Q2 2018 was US$595 trillion while the gross market value of OTC derivatives in the same period was US$10 trillion.23In the context of disruption to existing wholesale payments clearing and settlement infrastructures such as the Large Value Transfer System (LVTS), payments made as part of the trade life cycle events in broader securities and derivatives markets may no longer require such infrastructure. Indeed the instantaneous cross-border transfer of digital tokens exchangeable for cash assets eliminates the need for cumbersome processes of intraday collateral management required by existing wholesale settlement systems. Moreover, as such tokens are not tied to the operating hours of the wholesale payments systems across jurisdictions, transactions are free to flow frictionlessly 24 hours a day and seven days a week.

Stablecoins for Cross-Border Payment

Stablecoin refers to a class of digital currencies which are relatively stable in terms of their price. Stablecoins offer instantaneous processing and security of payments as many cryptocurrencies do. They also offer stability with respect to their parity against fiat currencies. Two digital currencies that fall into this category are RippleNet’s native digital currency Ripple (XRP),24 and Stellar network’s native cryptocurrency, the Stellar Lumen (XLM)25. Both Ripple and Stellar enable faster and more efficient cross-border payments relative to correspondent banking. However, they differ in that Ripple is focused on improving cross-border settlement between international banks, whereas Stellar is focused on providing low-cost cross-border payment financial services to the end-user and the unbanked population.

Ripple enables multinational corporations to settle cross-border payments by transferring XRP through the Ripple network, resulting in on-demand liquidity. The three parts of the Ripple ecosystems are i) Servers that maintain the ledger. ii) Clients. iii) Intermediaries. Unlike Bitcoin or Ethereum, Ripple does not run proof of work nor does it run a proof of stake consensus mechanism. Instead, Ripple transactions rely on a Byzantine Generals Problem (BGP)26 consensus protocol, known as Ripple gateways, to validate account balances and transactions of the system. The Ripple settlement process involves the creation of a transaction that is signed by the account owner and submitted to the network. Badly formed transactions will be rejected immediately, otherwise, they are provisionally included on the ledger. The Ripple network has many validating nodes which are used to validate and verify transactions. For a successful transaction to take place, the validators must come to a consensus on the transaction. While Ripple claims to be decentralized, the argument could be that the 55 validator nodes belong to Ripple. This is expected to change as third party validator nodes join the network. As these third-part nodes join, each of the Ripple validator nodes will be removed for every two third party nodes that join. Ripple, under this setup, becomes increasingly decentralized with time.

Any accepted type of currency or asset can be used to transact on the Ripple Network, therefore cross-border payments using Ripple are essentially Ripple gateways transacting using XRP. Each transaction requires a small fraction of XRP to be destroyed in the process (0.00001 XRP), meaning the total supply of XRP decreases over time and, in theory, maintains its value.

By contrast, Stellar enables individuals, end-users, to trade money directly with each other across jurisdictions, using entrusted intermediaries to handle FX and funds transfer. Transaction confirmation time using Stellar has been observed to range from 1,000 transactions per second to approximately 10,000 transactions per seconds in a 2016 Barclays Africa and Deloitte pilot.27 Stellar’s transaction fees remained a fixed rate at 0.000001 XLM per transaction, thereby making XLM cost effective for retail cross-border transactions.

For a transaction to be processed in a few seconds, the Stellar network needs to reach consensus fast while ensuring accuracy.28 The Stellar Consensus Protocol (SCP) works by utilizing groups of trusted nodes that communicate among themselves to verify transactions. Consensus is achieved,on average, every two to five seconds between the trusted nodes. Unlike Ripple where decentralization is controlled by Ripple, decentralization in Stellar is expanded by trusted nodes deciding to extend trust to other nodes according to a Federated Byzantine Agreement (FBA).29 The Stellar Lumen can be traded to different currencies, which means that performing a cross-border transaction using XLM is essentially using XLM as the bridge currency between two jurisdictions. This currency bridge function is facilitated through the Stellar Decentralized Exchange (SDEX), an exchange allowing trading between domestic fiat currencies and XLM. As a decentralized exchange (DEX), SDEX is borderless and therefore is not subject to jurisdictional controls or frictions and currency exchange is done by way of atomic swaps.30 Similar to Ripple, the price of XLM depends on active trading against other currencies including fiat and the widespread adoption of the digital currency itself.

More recently, Facebook announced Libra, its own permissioned blockchain digital currency. Note that Libra is merely one of many social media digital currency platforms with some like LBRY and Steem being operational for a number of years now.31 Like Steem before it, Libra’s primary use would be in the area of P2P, P2B, and to pay for goods and services online. While Libra is still a relatively new digital currency, given the vast global network of approximately 2.6 billion (or one third of the global population) users in the Facebook ecosystem, Libra has a substantial advantage over many other stablecoins and digital currencies. As a digital currency not bound by borders, Libra has the potential to disrupt existing correspondent banking models of retail cross-border settlement.

What is the outlook of cross-border payment?

Currently, cross-border payments are dominated by correspondent banking. In the digital age of fledgling but booming exploration of an internet layer in payment mechanisms, consumers (corporates and individuals) expect cross-border transactions to be fast, frictionless, and affordable. There have been many attempts to improve the cross-border payment systems, however, some of the core challenges in correspondent banking remain unresolved. To address these frictions, solutions have emerged across different sectors. Large corporates and fintechs operating on a global scale entering the payments services space are able to address a number of these frictions through their reach and account holdings in various jurisdictions. These firms are able to timely and transparently facilitate cross-border payments by simply engaging in transfer pricing activities between their operations in various jurisdictions. In doing so, they also potentially also benefit from tax arbitrage. SWIFT have launched and are actively expanding the core functionality of their SWFT gpi platform to facilitate the instant and always on transmission of payments across borders. In conjunction with these global corporations and fintechs, there has been an expansion of emerging and incumbent DLT-based payment protocols that appear to be yielding promising results.

As DLT-based payment protocols gain ground, we could experience a proliferation of digital currency in the mid- to long-term. Whether it is central bank digital currency such as that envisioned under Project Jasper-Ubin, or private label cryptocurrency with the likes of Ripple and Stella, or perhaps a consortium of commercial banks that emerge with their digital currency (USC and JPM Coin), this emerging trend suggests that blockchain is here to stay.

Although DLT-based payment protocols and the internet layer for payment services remains nascent and unlikely to replace correspondent banking infrastructure on a large scale in the short term, its low cost, transparency, and real-time processing speed provide encouraging signs to the sector in their role in the future of cross-border payments.

From USC, JPM Coin, to Ripple, Stella and most recently Libra, these private sector emerging DLT-based payment protocols are competing in the wholesale and retail payments space and have the potential to erode established clearing and settlement services provided by central banks and institutions such as Payments Canada. It is therefore strategically important for Payments Canada to continue its close monitoring of events and innovations in digital currency, DLT, as well as emerging fintech.

Authors

Zheren Li

As a Research Assistant for the Research unit at Payments Canada, Zheren supports the industry publication of the Canadian Payment Methods and Trends report. Zheren also contributes to long-term research of relevance to Payments Canada, prepares and presents findings of research to internal researchers. His research interests include applied statistics, generalized linear and nonlinear regression models, and theoretical analysis of methods used in research. Zheren holds a Bachelor’s degree in Psychology and he is pursuing a Master’s degree in Organizational Psychology at Carleton University.

Segun Bewaji

As senior economist at Payments Canada, ‘Segun has conducted a wide range of research developing quantitative and forecast models that advise Modernization and Payments Canada’s corporate funding model. He has also developed market microstructure models of financial market infrastructures and is collaborating externally in the field of artificial intelligence and machine learning within payments. In his role, ‘Segun is the subject matter expert on distributed ledger technology and digital/cryptocurrencies, having participated in Payments Canada's Project Jasper, as well as the ongoing Jasper-Ubin project. ‘Segun has a Ph.D. in computational finance from the Center for Computational Finance and Economics Agents (University of Essex) specializing in the market microstructure of financial market regulation under the Basel Accords.

[1] Value of cross-border payments worldwide from 2016 to 2022, by type in trillion U.S. dollars. Available from: https://www.statista.com/statistics/609723/value-of-cross-border-payments-by-type/

[2] Bank for International Settlement (2018) Cross-border retail payments. Available from: https://www.bis.org/cpmi/publ/d173.pdf

[3] Nostro and vostro are two different terms to describe the same bank account, an account held by one bank to another is referred to by the holding bank as nostro account, and the same account is referred to as a vostro account by the counterpart bank.

[4] CPMI, “A glossary of terms used in payments and settlement systems”, March 2003 (updated June 2015), www.bis.org/cpmi/publ/d00b.htm?m=3%7C16%7C266.

[5] SWIFT Institute (2018). The Future of Correspondent Banking Cross Border Payments. Available from: https://swiftinstitute.org/wp-content/uploads/2018/10/SIWP-2017-001-The-Future-of-Correspondent-Banking_FINALv2.pdf

[6] MT103 is a SWIFT payment message format used for cross-border funds transfer.

[7] The future of cross border payments. Available from: https://www.forbes.com/sites/forbestechcouncil/2019/03/21/the-future-of-cross-border-payments/#5f246a812bcf

[8] SWIFT. Delivering the future of cross-border payments SWIFT gpi. Available from: https://www.swift.com/resource/swift-gpi-brochure

[9] SWIFT sees success with global instant cross-border payments with Singapore’s FAST https://www.swift.com/news-events/press-releases/swift-sees-success-with-global-instant-cross-border-payments-with-singapore_s-fast SWIFT enables payments to be executed in seconds https://www.swift.com/news-events/press-releases/swift-enables-payments-to-be-executed-in-seconds

[10] It should be noted that the term “digital currency” is used here by definition in the general sense. This is different from the term “virtual currency” which refers to a type or class of digital currency, meaning that all virtual currencies are digital, but the converse is incorrect. For example, cryptocurrencies like Bitcoin are a type of digital currency, but they are in a separate category from virtual ones. Other types of digital currency also exist and include funds in e-wallets and central bank digital currency (CBDC). Virtual currencies, by contrast, are used primarily for online entertainment in virtual worlds and intended to be light-hearted and fun: not intended for use in “real life,” or expenditure on real assets. They can be considered as assets depending on the underlying economics of the intersection between the virtual worlds they are used in and the real world. For example, online video game World of Warcraft (WoW) tokens currently trade at 177,828 gold per US dollar (https://wowtokenprices.com/extended-history).

[11] Bitcoin relies on a consensus mechanism (a cryptocurrency equivalent to consensus of authorization given to the settlement infrastructure by participants and regulators of the payments system). Proof of work is a requirement to define a computer calculation, also known as minging. It is needed in order to create new blockchain., The two purposes of ming is to verify the legitimacy of the transaction and to create new digital currency by rewarding miners for performing the task of mining. Other consensus mechanisms exist which do not require as much mining such as the Proof of Stake mechanism used in Ethereum. Under this mechanism, a validator is given the authorization to mine (i.e. process and validate blocks of transactions) according to the stake they own in the currency.

[12] Bank of Canada (2018). Central Bank Digital Currency and Monetary Policy. Available from: https://www.bankofcanada.ca/wp-content/uploads/2018/07/swp2018-36.pdf

[13] The wholesale variant CBDC is limited to a predefined group of users, mostly used for interbank clearing and settlement. It would operate on blockchain technology and a centralized ledger. It also exhibits certain qualities similar to that of a cryptocurrency - enabling instantaneous transactions and borderless transfer-of-ownership.

[14] Jasper–Ubin Design Paper Enabling Cross-Border High Value Transfer Using Distributed Ledger Technologies from: https://www.mas.gov.sg/-/media/Jasper-Ubin-Design-Paper.pdf

[15] Enabling Cross-Border High Value Transfer Using Distributed Ledger Technologies. Available from: https://www.accenture.com/_acnmedia/PDF-99/Accenture-Cross-Border-Distributed-Ledger-Technologies.pdf

[16] Permission-based means transacting parties only transact with ones that are on the same ledger. Parties that are not on the same ledger would transact by either using intermediaries or access to a central bank liability.

[17] Smart contract is programmable lines of code that binds the parties with the terms of agreement and commitments to the trade.

[18] What is ‘Utility Settlement Coin’ really? Available from: https://ftalphaville.ft.com/2017/09/18/2193542/what-is-utility-settlement-coin-really/

[19] J.P. Morgan creates digital coin for payments. Available from: https://www.jpmorgan.com/global/news/digital-coin-payments

[20] Major Utility Settlement Coin Project Raises $63 Million for Commercial Realization. Available from: https://cointelegraph.com/news/major-utility-settlement-coin-project-raises-63-mln-for-commercial-realization

[21] Largest Number of Banks to Join Live Application of Blockchain Technology. Available from: https://www.jpmorgan.com/global/treasury-services/IIN

[22] Banks invest $50 million in institutional digital currency project Available from: https://www.ledgerinsights.com/institutional-digital-currency-fnality-usc-utility-settlement-coin/

[23] Bank For International Settlement (2018) Statistical release: OTC derivatives statistics at end-June 2018. Available from: https://www.bis.org/publ/otc_hy1810.pdf

[24] Ripple. Available from: https://www.ripple.com/

[25] Stellar. Available from: https://www.stellar.org/lumens/

[26] First proposed in 1982 by Marshall Pease, Robert Shostak and Leslie Lamport, the BGP conceptually imagines that several divisions of the Byzantine army are camped outside an enemy city, each division commanded by its own general. The generals can communicate with one another only by messenger. After observing the enemy, they must decide upon a common plan of action. However, some of the generals may be traitors, trying to prevent the loyal generals from reaching agreement. The generals must therefore devise an algorithm to guarantee that (A) All loyal generals decide upon the same plan of action and (B) A small number of traitors cannot cause the loyal generals to adopt a bad plan. For further details refer to Marshall Pease, Robert Shostak and Leslie Lamport (1982) “The Byzantine Generals Problem”, ACM Transactions on Programming Languages and Systems (TOPLAS), Volume 4 Issue 3, July 1982, Pages 382-401 https://www.academia.edu/27660079/The_Byzantine_Generals_Problem.pdf?source=swp_share

[27] How Many Transactions Per Second Can Stellar Process? Available from: https://www.lumenauts.com/blog/how-many-transactions-per-second-can-stellar-process

[28] Consensus means that the entire network reaches an agreement on the transacting value, it is a vital component of decentralized network.

[29] FBA comes to agreement on state updates using a unique slot where update dependencies between nodes are inferred. Nodes must agree on the slot update in each round of consensus. However, since the system is open to nodes joining and leaving the network at will, a majority-based quorum consensus mechanism will not work. Instead, the FBA in the SCP employs quorum slices that are subsets of quorums that are capable of convincing particular nodes of an agreement. Refer to the SCP White Paper (https://www.stellar.org/papers/stellar-consensus-protocol.pdf) and Blockonomi (https://blockonomi.com/stellar-consensus-protocol/) for more details.

[30] Atomic swaps, or atomic cross-chain trading, is the exchange of one cryptocurrency for another cryptocurrency (or rarely, fiat currency), without the need to trust a third-party. A relatively new piece of technology, atomic cross-chain trading looks to revolutionize the way in which users transact with each other. For example, if Alice owned 5 Bitcoins but instead wanted 100 Litecoins, she would have to go through an exchange, i.e. a third-party. However, with atomic swaps, if Bob owned 100 Litecoins but instead wanted 5 Bitcoins, then Bob and Alice could make a trade. In order to prevent, for example, Alice accepting Bob’s 100 Litecoins but then failing to send over her 5 Bitcoins, atomic swaps utilizes what is known as hash time-locked contracts (HTLCs). For more on atomic swaps see https://www.cryptocompare.com/coins/guides/what-are-atomic-swaps/

[31] Steem is the Steemit ecosystem issued stablecoin with a construction similar to a self contained macroeconomy having what is akin to government securities with short to longer term note maturity/term structures. For an overview of the economics of Steem, refer to https://steemit.com/steem/@spectrumecons/steem-explained-by-an-economist

Disclaimer: The views presented in this paper are those of the authors and do not necessarily reflect the views of Payments Canada.